How some Nigerians get into chronic debt, and how to get out

Let's face it – getting caught in a debt spiral is easier than we'd like to admit. Kiki's story shows how quickly a celebration can turn into a financial nightmare. But here's the good news: there's always a way out, even when things seem hopeless.

How to use Mono with Lendsqr for credit scoring

Mono is on a mission to power the digital economy in Africa, using open banking as a layer for financial data, identity data, and bank transfer payments for businesses.

Best loan apps to get urgent 10,000 naira in Nigeria

In this article, we’ll explore the best loan apps in Nigeria to help you secure an urgent 10,000 naira quickly and easily so you can handle life’s unexpected challenges without the added stress.

How to use Monnify with Lendsqr for loan repayments

Ensure smooth loan repayments with Lendsqr's integration of Monnify, one of Africa's reliable payment gateways for seamless transactions and minimized losses.

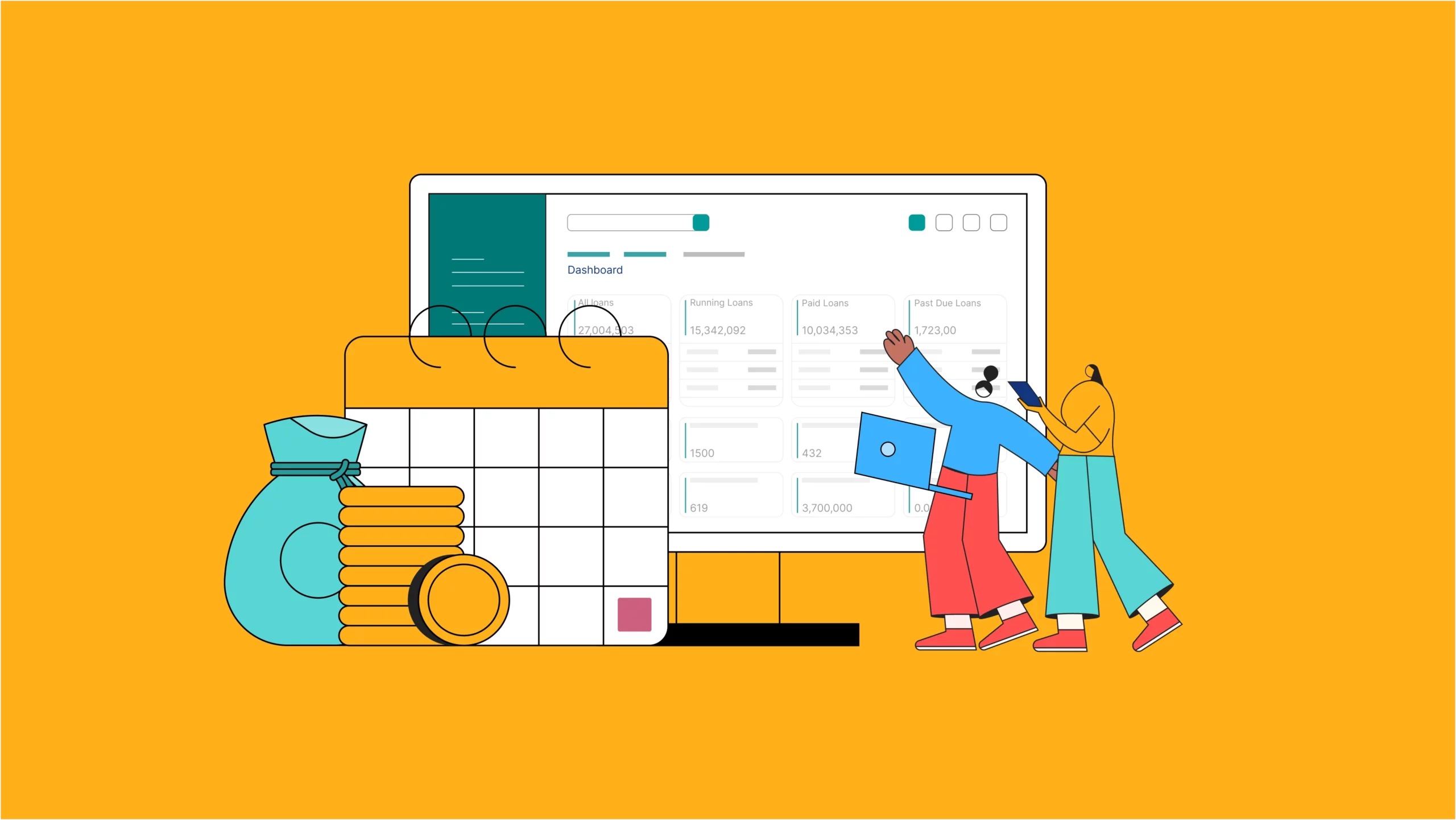

What to consider when setting up a payday loan software

Payday loans are short-term loans that help borrowers bridge the gap between paychecks. Essentially, a Payday loan is any loan that’s tied to a salary date. Now, let’s take a look at some things to consider when setting up payday loan software

Where and how to get an urgent 5,000 naira loan in Nigeria

With loan apps, you can get the money you need deposited straight into your bank account, in just a few minutes after they approve your loan.

Why and how to migrate from Loandisk to Lendsqr

For whatever reason you decide to migrate from Loandisk to Lendsqr, rest assured that the grass is greener on this side.

How to secure a loan without collateral

Loans are frequently tied to collateral. However, what isn’t commonly known is that not all loans require it. So how do lenders handle such risky loans?

Where and how to get an urgent 100,000 naira loan in Nigeria

After reading this, whatever 99 problems Nigeria throws at you or your business, knowing where and how to get an urgent N100000 loan won't be one.

All you need to set up a student loan software

In most advanced countries, student loans are the norm, allowing almost everyone to attend university. Sadly, that’s yet to be the case in Nigeria.

How to use NIBSS with Lendsqr for loan repayments

Using NIBSS' direct debit system on Lendsqr loan management software is easy, as it's natively integrated into the platform.